In the ever-evolving world of fashion, men's style remains a steadfast beacon of sophistication and elegance. The modern man's wardrobe is a fusion of classic charm and contemporary trends, offering an array of options that transcend seasons.

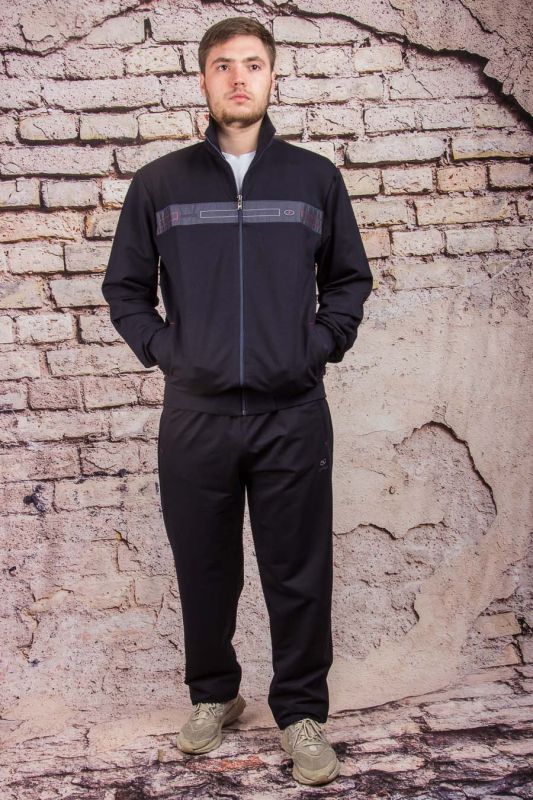

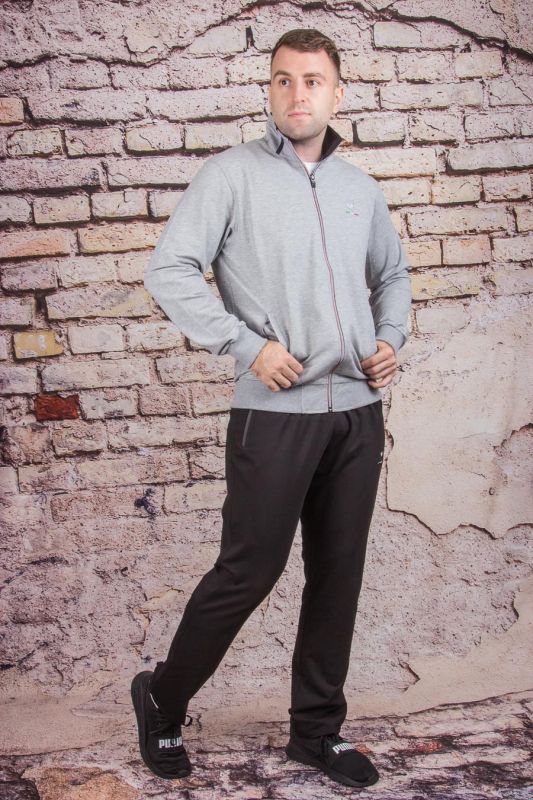

From the tailored precision of a well-fitted suit to the relaxed allure of smart-casual attire, today's men are embracing versatility without compromising on refinement. The essence lies in the details—a perfectly tailored shirt, impeccably crafted accessories, and carefully selected footwear can elevate any ensemble.

Beyond trends, timeless pieces endure. Investing in quality garments not only exudes confidence but also reflects an understanding of enduring style. Layering textures, experimenting with colors, and playing with silhouettes allow men to express their individuality while staying true to classic sensibilities.

Ultimately, the essence of men's fashion lies not in following fleeting trends, but in curating a wardrobe that embodies sophistication, versatility, and enduring style—a narrative that transcends time.